A personalised, scenario driven, “What-if…?” presentation system for retirement distribution.

Retirement Test Drive gives your clients the visual comparisons they need to see their situation and problems, and to understand the implications and solutions to those problems. Before making any changes in their current plan, clients can see VISUALLY how a proposed change would help them.

Click image to enlarge

Here’s How

- Financial goals are realistic and what the client REALLY thinks their goals are:

- Anticipated payments and expenses

- Possible gifts

- Desired future purchases

- Which assets they would be willing to use and for which goals

- Which assets they definitely would NOT want to use

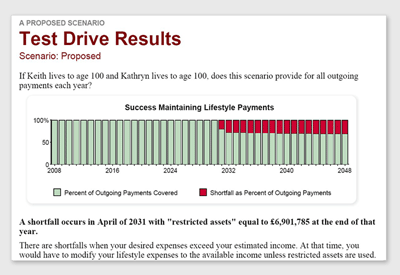

- The results are quick and simple; you either have enough or you don’t.

- Shortfalls are not seen as being “penny-less.”

- It points out how much their assets are worth at the time of the shortfall.

- A shortfall just means they have to adjust their lifestyle or use some of their restricted assets.

- The situation is not hopeless but points out that they need planning.

- We then make intelligent suggestions based on what the program has calculated or knows.

- Point out additional savings required to eliminate the shortfalls

- Not just recommend downsizing, if they own a home, but they can see how much equity is in their home at the time of the shortfall

- Helps them to distinguish between expenses for nice to have items and those essential to their lifestyle

- Comparisons are visual -- clients SEE the differences

- For the clients, we made it quick and simple and accurate.

Click image to enlarge

It’s made it easy for YOU to become a retirement planning specialist.

You don’t need to be trained in retirement planning distribution, all you have to do is use the multiple scenarios and the visual results: you can see whether each recommendation is better or not, if it is, save it and build upon it. If you NEED direction or guidance, the program provides that through the test drive result pages where it shows the intelligent solutions/suggestions. You can see different things to try, by getting recommendations and VISUAL feedback.

Click image to enlarge

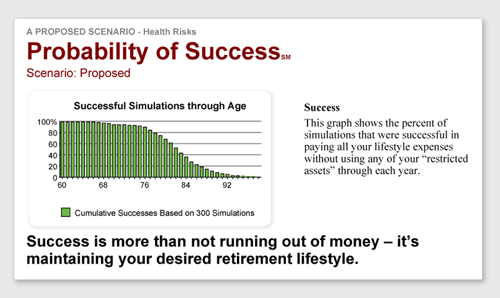

Unique adverse risks calculations show mortality risks and health risks – ideal for illustrating life insurance and long-term care insurance in addition to retirement products.

You also get printing and graphing flexibilities to fit every client.

A Multiple Scenario, Visual Presentation System for Retirement Distribution Planning!

Subscribe Now

Requirements:

- Internet Explorer 7 or greater,

Firefox 3 or greater

- Adobe Reader 7.0 or greater

- Connection to the internet

PlanLab®

This product sits on the Web-based PlanLab platform. The complete functionality of PlanLab comes in an easy-to-use, web-based package that requires little

or no training to get started. Intuitive features in PlanLab make it easy to collect and analyse client data, motivate clients to action, and monitor their progress.

For more information or to arrange for a demonstration, please email

sales@bmcprofiles.com or call 01743 248515.

“I want a retirement plan built on my goals, my lifestyle, my dreams, and with my assets—not a ‘one size fits all’ plan.”

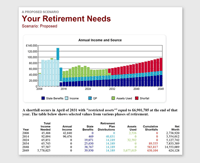

Detailed cash flow analysis using all of the specific information provided by the client.

“I have lots of ‘What if…?’ questions that must be answered before I can make long-range decisions.”

Multiple scenario and comparison graphs let you see the answers to all of your “What if’s.”

“Before we start making changes, we want to know where our current situation is headed.”

Test drive existing plans to see where retirement is headed. Also, test drive any changes you are considering.

“Will an extended nursing home stay, or home healthcare requirement wreck retirement?”

“Will there be enough income for my spouse if I die sooner than expected? Or, am I likely to out-live my income if I live longer than average?”

Adverse risk pages let you see the effects of dying in various years.

View All Products